Economists are better at history than forecasting. This explains why financial journalists sound remarkably intelligent explaining yesterday’s stock market activity and, well, less so when predicting tomorrow’s market movements. And why I concentrate on economic and financial history. Since 2015 is now in the history books, this is a good time to summarize a few main economic trends of the preceding year.

The post Economic trends of 2015 appeared first on OUPblog.

By Richard S. Grossman

For the past half dozen years or so, the first Friday of the month has brought fear and dread to large portions of the United States. This heightened anxiety has nothing to do with the phases of the moon, the expiration of multiple financial derivatives, or concerns about not having a date for the weekend. No, at 8:30 am (Eastern Time) on the first Friday of each month, the US Bureau of Labor Statistics releases the unemployment data for the previous month.

The release of the unemployment data sets off a media frenzy, as pundits speculate on the winners and losers. What do the numbers foreshadow for the economy? Have we put the Great Recession behind us? How will Wall Street receive the news? And, perhaps most importantly, how does it affect the Administration’s popularity?

There are plenty of reasons why unemployment should be the “marquee” economic statistic. Unlike other important economic indicators, such as GDP, exports, and new housing starts, the human cost of unemployment is inescapable. On an aggregate level, every tenth of a percent increase in the unemployment rate represents about an additional 200,000 people out of work. It is a lot tougher to conjure up a picture of a 1.2 percent decline in GDP.

On the personal level, when unemployment touches our family, friends, and neighbors, it is hard to ignore.

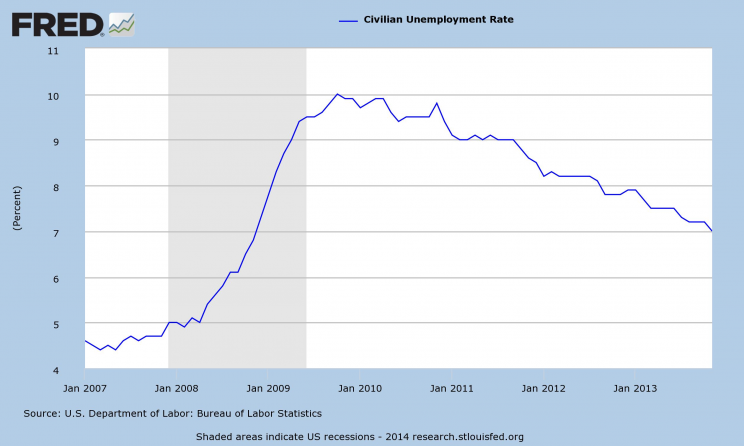

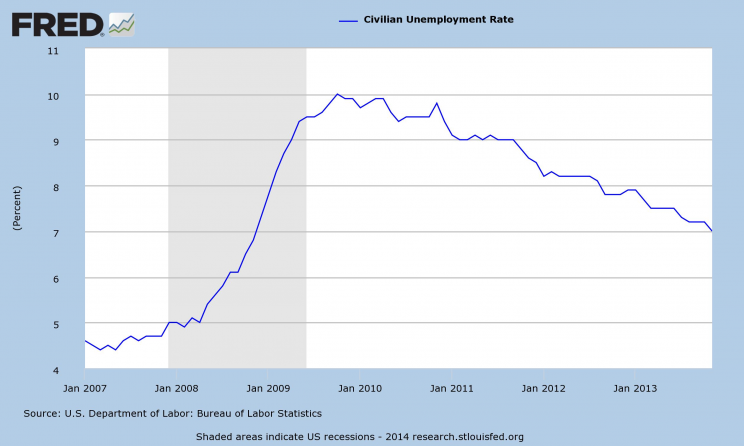

The unemployment rate has been at the center of a monthly drama since the beginning of the Great Recession. As the economy worsened, the unemployment rate surged upward until it hit 10% of the workforce in October 2009, its highest rate in more than 25 years.

Data Source: FRED, Federal Reserve Economic Data, Federal Reserve Bank of St. Louis: Civilian Unemployment Rate (UNRATE); US Department of Labor: Bureau of Labor Statistics; accessed 19 May 2014.

With each uptick in unemployment, political analysts wondered out loud if the bad news spelled the failure of the Obama presidency…or the lengthening of the odds against his chances at a second term. For the Administration’s part, the chair of the President’s Council of Economic Advisors typically puts out a statement by 9:30 am on the day of the release, putting the best spin possible on the unemployment data.

Although the unemployment numbers have been and will remain an important economic indicator, in recent months their importance is being overshadowed by another statistic: inflation. There are a couple of reasons for this.

First, even though the unemployment rate has fallen consistently since November 2010, when it was 9.8%, until April 2014, when it was 6.3%, it is clear that the economy has not fully recovered from the Great Recession. Wage growth is anemic; there are still an alarming number of discouraged workers (who are no longer counted as unemployed because they have given up looking for work); and GDP growth is sluggish.

Second, despite the continuing weakness in the economy, lower unemployment has raised concerns that that the economy is overheating. Declining unemployment combined with several years of monetary stimulus via quantitative easing and other unconventional methods has led to concerns that inflation may emerge at any moment.

So far, there is little evidence that we are experiencing a sharp upturn in inflation. Nonetheless, concern that emerging inflation will force the Fed to undertake contractionary monetary policy which, in turn, may have adverse effects for both the high flying stock market and the still low flying economy, are now gaining ground.

Don’t expect the unemployment rate to sink into obscurity anytime soon. It has always been an important indicator of the health of the economy and will remain so. Just be prepared for a second media frenzy around the middle of each month—when the inflation indices are released.

Richard S. Grossman is Professor of Economics at Wesleyan University and a Visiting Scholar at the Institute for Quantitative Social Science at Harvard University. He is the author of WRONG: Nine Economic Policy Disasters and What We Can Learn from Them and Unsettled Account: The Evolution of Banking in the Industrialized World since 1800. His homepage is RichardSGrossman.com, he blogs at UnsettledAccount.com, and you can follow him on Twitter at @RSGrossman. You can also read his previous OUPblog posts.

Subscribe to the OUPblog via email or RSS.

Subscribe to only business and economics articles on the OUPblog via email or RSS.

The post Changing focus appeared first on OUPblog.