new posts in all blogs

Viewing: Blog Posts Tagged with: credit, Most Recent at Top [Help]

Results 1 - 7 of 7

How to use this Page

You are viewing the most recent posts tagged with the words: credit in the JacketFlap blog reader. What is a tag? Think of a tag as a keyword or category label. Tags can both help you find posts on JacketFlap.com as well as provide an easy way for you to "remember" and classify posts for later recall. Try adding a tag yourself by clicking "Add a tag" below a post's header. Scroll down through the list of Recent Posts in the left column and click on a post title that sounds interesting. You can view all posts from a specific blog by clicking the Blog name in the right column, or you can click a 'More Posts from this Blog' link in any individual post.

By: Amelia Carruthers,

on 7/25/2015

Blog:

OUPblog

(

Login to Add to MyJacketFlap)

JacketFlap tags:

Philosophy,

justice,

credit,

debt,

morality,

the republic,

Socrates,

promises,

william godwin,

*Featured,

Business & Economics,

david hume,

rationality,

Arts & Humanities,

Alexander X. Douglas,

Political Justice,

Treatise of Human Nature,

Books,

Economics,

ethics,

Add a tag

William Godwin did not philosophically address the question of debt obligations, although he often had many. Perhaps this helps to explain the omission. It’s very likely that Godwin would deny that there is such a thing as the obligation to repay debts, and his creditors wouldn’t have liked that.

The post William Godwin on debt appeared first on OUPblog.

By: Kate Guenther,

on 2/18/2015

Blog:

OUPblog

(

Login to Add to MyJacketFlap)

JacketFlap tags:

money,

recession,

Financial,

Durkin,

business,

Finance,

Business & Economics,

Books,

Economics,

Thomas Durkin,

economy,

*Featured,

Social Sciences,

credit,

american economy,

Consumer Credit,

Consumer Credit and the American Economy,

Add a tag

A news release on 6 February 2015 from the Federal Reserve Board, together with a selection of dense numerical tables, showed once again that consumer credit in use has increased over the course of a year. This is the fourth year in a row and the 67th yearly increase in the 69 years since 1945. But does this mean that credit growth is a meaningful worry? Total consumer sector income and total assets have also increased in 67 of the 69 years since World War II.

The post Is consumer credit growth worth worrying about? appeared first on OUPblog.

By: Kirsty,

on 2/13/2013

Blog:

OUPblog

(

Login to Add to MyJacketFlap)

JacketFlap tags:

Economics,

Current Affairs,

money,

bank,

card,

Finance,

credit card debt,

credit,

debt,

credit cards,

expenses,

graph,

interest,

irina,

*Featured,

median,

Business & Economics,

the review of economic studies,

credit repayments,

irina a. telyukova,

liquid assets,

personal debt,

why don't people pay off credit card debt,

telyukova,

Add a tag

By Irina A. Telyukova

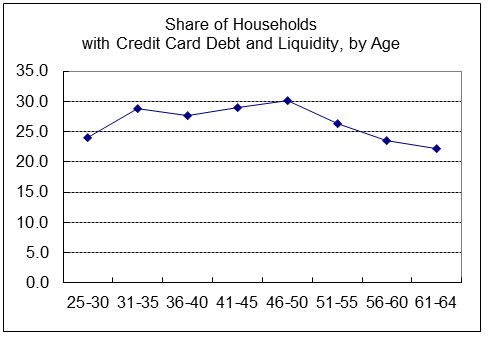

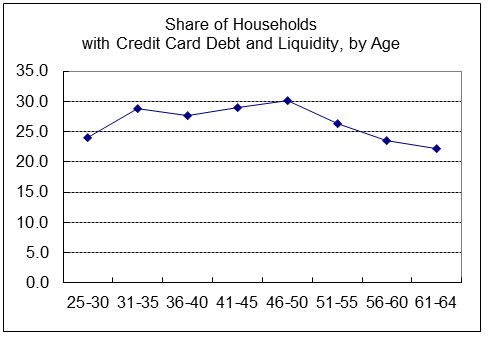

In the United States, around 25% of households tend have a substantial amount of expensive credit card debt that they carry over multiple months or even years, while also holding significant liquid assets, i.e. balances in checking and savings accounts.

For example, in 2001 data, such households paid an average 14% interest rate on the credit card, while earning nearly no return on the bank accounts. A median such household had $3800 in credit card debt, and $3000 in the bank. The average amounts were about $5800 and $7200, respectively. This behavior is quite persistent with age, as the picture below shows. It is also persistent over time, at least over the last two decades. The statistics for 2010 are very close to those for 2001.

It may seem that given the cost of revolving credit card debt, people should pay it off if they have any money in the bank. Hence, the phenomenon has been termed the “credit card debt puzzle”. Much of the discussion of it in the literature interpreted it as evidence that people lack self-control, or that they lack the financial sophistication to plan properly. In my study, I instead focused on a more familiar idea: that people hold on to money in the bank because they may need it for expenses for which credit cannot be used, and such expenses could be large and unexpected. Not only do we pay our rents and mortgages still largely by check or electronic payment from the bank, but if we have a large car or home repair to take care of, the contractor might give preferential pricing to a cash payment or simply not accept credit cards. Indeed I find that homeowners are more likely to simultaneously have debt and money in the bank, and that home repairs are an important source of large and unpredictable expenses for most households. Then, even if a household has credit card debt, it may not be optimal to draw down the bank account to zero to repay the debt. Incidentally, this idea has been advanced in the past by those who have studied the same behavior on the side of firms.

The story is intuitive; the difficult part is measuring how well this explanation can account for the puzzle, because we do not have good data on how people pay for things during a typical month, and because it is difficult to disentangle which expenses are unpredictable. Nevertheless, using several household surveys and a model of household portfolio choice, I measured both typical monthly liquid expenses (i.e. those done by cash, check, debit and other ways that require the bank account to have a positive balance), and the extent of uncertainty in them. I find that for the median person, there appears to be enough uncertainty to warrant holding on the order of $3,000 of liquid assets, even if she has credit card debt as well. In other words, many people who simultaneously have credit card debt and money in the bank are behaving without violation of self-control or rationality, under the constraint that they do not have enough money both to pay off their debt and attend to their expected monthly expense needs.

The story is intuitive; the difficult part is measuring how well this explanation can account for the puzzle, because we do not have good data on how people pay for things during a typical month, and because it is difficult to disentangle which expenses are unpredictable. Nevertheless, using several household surveys and a model of household portfolio choice, I measured both typical monthly liquid expenses (i.e. those done by cash, check, debit and other ways that require the bank account to have a positive balance), and the extent of uncertainty in them. I find that for the median person, there appears to be enough uncertainty to warrant holding on the order of $3,000 of liquid assets, even if she has credit card debt as well. In other words, many people who simultaneously have credit card debt and money in the bank are behaving without violation of self-control or rationality, under the constraint that they do not have enough money both to pay off their debt and attend to their expected monthly expense needs.

While the story accounts for the median amount of money held in the bank by those who also have credit card debt, the average household has a lot more money in the bank, and more money than credit card debt. This means that there are people who have very large amounts of liquid assets while still revolving credit card debt. While such households may face more severe risks than the average case that I measured, and while some may hold money in the bank because they foresee a possibility of a job loss and want to be able to pay at least their average expenses, it does suggest that some people may be able to improve their financial positions by examining their bank and credit card balances, and the interest costs that they pay on the credit card debt, to see if they can pay off some of their debt using their money in the bank.

Irina A. Telyukova is an assistant professor of economics at the University of California, San Diego. Her research focuses on different aspects of household saving. She has several publications on credit card debt and money demand. Her current research is about the use of home equity in retirement, in the United States and across countries, including a study about reverse mortgages. She is the author of the paper ‘Household Need for Liquidity and the Credit Card Debt Puzzle’, which appears in The Review of Economic Studies.

The Review of Economic Studies aims to encourage research in theoretical and applied economics, especially by young economists. It is widely recognised as one of the core top-five economics journal, with a reputation for publishing path-breaking papers, and is essential reading for economists.

Subscribe to the OUPblog via email or RSS.

Subscribe to only business and economics articles on the OUPblog via email or RSS.

Image Credits: (1) Graph produced by the author. Do not reproduce without permission. (2) Credit Card. By Gökhan ARICI, iStockphoto

The post Why don’t people pay off credit card debt? appeared first on OUPblog.

By: Megan,

on 2/3/2009

Blog:

OUPblog

(

Login to Add to MyJacketFlap)

JacketFlap tags:

tips,

Economics,

Business,

money,

A-Featured,

Dictionaries,

taxes,

Finance,

Rich,

credit,

retirement,

investment,

David Bach,

Finish Rich,

Finish,

Add a tag

Megan Branch, Publicity Intern

David Bach is the best-selling author of the eight books in the Finish Rich  series as well as Fight for Your Money and The Automatic Millionaire. In the latest book in the Finish Rich series, The Finish Rich Dictionary, Bach defines 1001 essential financial terms and provides 10 helpful essays with topics ranging from understanding a credit score to planning for retirement. Below we have excerpted five of Bach’s ten most interesting money mistakes people make.

series as well as Fight for Your Money and The Automatic Millionaire. In the latest book in the Finish Rich series, The Finish Rich Dictionary, Bach defines 1001 essential financial terms and provides 10 helpful essays with topics ranging from understanding a credit score to planning for retirement. Below we have excerpted five of Bach’s ten most interesting money mistakes people make.

Mistake #1: Having a 30-year mortgage.

A typical 30-year mortgage at 8 percent inflates the real cost of a $250,000 home to more that $666,000. If you paid off your mortgage in 15 years, the total cost of your house would come to just under $493,000. That’s nearly $168,000 less than it would have been with a 30-year mortgage.

Make a small extra payment each month or fork over a larger lump sum at the end of the year. By making an extra 10-percent payment each month and then adding an extra month’s payment at the end of the year, for example, you can pay off your 30-year mortgage in about 18 years.

Mistake #2: Waiting to buy a house.

When you own your own home, you are building equity for yourself. When you rent, you are building someone else’s equity.

The number-one reason people put off buying a home is because they think they can’t afford it. But you don’t need tens of thousands of dollars in the bank for a down payment. All lenders will provide 75 percent of the purchase price of your house or condominium, and many banks will lend as much as 95 percent.

You can probably get a substantial home for the equivalent of your current rental payment. Say you pay $2,000 a month in rent. For that kind of money, you could get a $250,000 mortgage. In most of the country, $250,000 can buy you a lot of house.

Mistake #3: Putting Off Saving for Retirement

Almost 95 percent of Americans age 65 or older have an income of less than $25,000 a year. That means only 5 percent of us are in a position of financial security, much less comfort, when we reach our so-called golden years.

The best way to get started saving for retirement is to arrange to have your monthly contribution either deducted directly from your paycheck or automatically transferred from your checking account each month. If you’re not yet using your retirement account at work, go in to the office and sign up for your plan today. Make it a goal to save 10 percent or more of your gross income. If you can’t imagine saving 10 percent, start with 3 percent and make it a goal to increase that amount by a small percentage every month (you’ll barely feel it). By the end of the year, you’ll be contributing the maximum allowable amount to your retirement account at work.

Mistake #4: Paying too much in taxes.

When you are building an investment portfolio, it is absolutely imperative that you take into consideration your potential tax liability. Financial advisers call this “looking for the real rate of return.” The more you seek to minimize your taxes when investing, the more money you’ll keep. Start by making it a goal to fully invest in your 401(k) plan or retirement plan at work. No plan at work? Make sure you use an IRA account. Once you’ve maxed out your retirement accounts, look to investments that grow tax-free (like tax-free bonds).

Mistake #5: Giving Up.

People often make a financial mistake, get bad advice, and then give up on their dream of financial security. Don’t let this happen to you.

Yes, you should be careful, but don’t become overcautious. By learning to avoid the common pitfalls investors make, you can minimize your risk and put yourself on the road to financial security. The biggest mistake you can make is to not become an investor.

By: Cassie,

on 10/31/2008

Blog:

OUPblog

(

Login to Add to MyJacketFlap)

JacketFlap tags:

History,

Poetry,

American History,

A-Featured,

great depression,

Finance,

david,

moody,

credit,

cantos,

ezra pound,

financial crisis,

Add a tag

by Cassie, Publicity Assistant

A. David Moody is Professor Emeritus of the University of York and the author of Ezra Pound, Poet: Volume 1: The Young Genius 1885-1920. In the following piece, Moody looks at the Pound’s opinions on democracy and the economy, showing us that Pound’s opinions in the 1930s line up fairly well with the pundits of today. This piece is also timely since October 30th is Pound’s birthday and he died on November 1, 1972.

I am finding it hard to pin down a feeling I have these days as I read the pundits on the current financial crisis and hear echoes all the time of what Ezra Pound was writing in the 1930s. But Pound was called a crank for his beliefs.

“The provision of finance is a utility, just like the distribution of water and energy. Yet this public good is in the hands of private sector managers who have done a disastrous job.”

“The provision of finance is a utility, just like the distribution of water and energy. Yet this public good is in the hands of private sector managers who have done a disastrous job.”

(Guardian (London), editorial comment, 9 Oct. ‘08)

“The City has become a ghetto where greed (never mentioned) is all but an absolute good.”

(Andrew Phillips (Lord Phillips of Sudberry), City solicitor, Guardian 16 Oct. ‘08)

“Financiers have organized themselves so that actual or potential losses are picked up by somebody else—if not their clients then the state – while profits are kept to themselves.”

(Will Hutton, Observer (London), 27 Jan. ‘08)

“There is a chance to make finance once again the servant of the public, as it should be.”

(Larry Elliot, Economics Editor, Guardian (London), 15 Oct. ‘08)

“The Bank of England can directly create sterling assets (that is, print money) if it needs to”—i.e. it does not have to “borrow” from the banks it has just had to bail out.

(Gavyn Davies, partner in Goldman Sachs, Guardian (London), 9 Oct. ‘08)

“[The government] pays interest to private organizations for the use of its own credit . . . So that actually the government is getting itself into debt to the banks for the privilege of helping them to regain their stranglehold on the economic life of the country.”

(Senator Bronson Cutting, New York Times, 20 May 1934 – from a speech Pound commended.)

Pound might have written all of those things, if in his own terms. (”Leveraging” was not a current term in the 1930s, so he used plain terms: banks were lending money they did not have, to their own profit and the public’s loss.) As early as 1919 he was trying to understand how it was that, in a democracy, power to secure to the people “life, liberty and the pursuit of happiness” was not with the people, but with those few who owned and controlled the people’s credit and who were capable of exercising it against the common interest. And he was already arguing that it is the function and responsibility of the state, that is, of the government appointed by the people, to create and to regulate the nation’s credit, and to prevent it being usurped by private interests.

Pound’s prophetic critique of anti-democratic capitalism became a major theme after the 1929 Crash and the Great Depression of the 1930s—and it led to his being falsely accused of being himself anti-democratic. But in this time of financial crisis, and with it being near to the anniversaries of his birth and death (born 30 October 1885; died 1 November 1972), it is fitting to celebrate the now undeniable fact that, while he did go wrong in some ways, Pound was fundamentally right about the damage done to the whole society by unrestrained greed in the financial system, and about it being the responsibility of governments to issue and to control credit. It would be a good moment to read and to take the point of his cantos 31-51, particularly those about the American bank wars of 1829-35 and 1863.

employing means at the bank’s disposal

in deranging the country’s credits, obtaining by panic

control over public mind” said Van Buren

(Ezra Pound, Canto 37)

Further quotations:

“Banking should be treated as a utility.”

(Martin Wolf, Financial Times)

“The reckless greed of the few harms the future of the many.”

(Will Hutton, Observer (London), 27 Jan. ‘08)

“The sin of usury, diluted in the 1500s, should be brought back—usury, reaping that which one did not sow.”

(Ann Pettifor, political economist, Guardian (London), 11 Oct. ‘08)

“It is not money that is the root of the evil. The root is greed.”

(Ezra Pound, Gold and Work, 1944)

“Hopefully our democracies are strong enough to overcome the power of money and special interests.”

(Joseph Stiglitz, formerly Chief Economist of the World Bank, Guardian (London), 16 Oct. ‘08)

“The state can lend money.”

(Ezra Pound, Canto 78)

“It is an infamy that the STATE in, and by reason of, the very act of creating material wealth should run into debt to individuals.”

(Ezra Pound, New English Weekly, 5 July 1934)

ShareThis

By: Rebecca,

on 4/2/2008

Blog:

OUPblog

(

Login to Add to MyJacketFlap)

JacketFlap tags:

shopping,

cards,

Media,

cash,

card,

swipe,

credit,

debt,

banking,

stuart,

vyse,

Add a tag

Stuart Vyse is Professor of Psychology at Connecticut College, in New London. In his new book, Going Broke: Why Americans Can’t Hold On To Their Money, he offers a unique psychological perspective on the financial behavior of the many Americans today who find they cannot make ends meet, illuminating the causes of our wildly self-destructive spending habits. In the article below he looks at how credit cards lead to debt problems. Read Vyse’s other posts here.

Suddenly cash isn’t quick enough for our fast-paced world. If you want to be happy and efficient and avoid the critical stares of cashiers and fellow customers, you need to swipe or tap a card and keep the line moving. According to the latest round of credit card commercials, checks and cash are just so 20th Century. (more…)

Share This

By: Rebecca,

on 9/11/2007

Blog:

OUPblog

(

Login to Add to MyJacketFlap)

JacketFlap tags:

sark,

channel,

feudalism,

carts,

locomotion,

microstates,

principalities,

blog,

oxford,

Geography,

maps,

A-Featured,

Ben's Place of the Week,

atlas,

ben,

bicycles,

keene,

Add a tag

Sark, United Kingdom

Coordinates: 49 25 N 2 22 W

Approximate area: 2 square miles (5 sq km)

Times change, and with them, people and places are carried along on the tide of modernization. But not always. On the tiny island of Sark in the English Channel, feudalism has clung, virtually unnoticed, to its rocky shores since the Middle Ages. In fact, this hereditary form of rule hung on long enough to make it the only feudal territory left on Europe, a continent known (among political geographers at least) for its microstates and puny principalities. (more…)

Share This

I’ve enjoyed Bach’s financial advice books, particularly “Start Late, Finish Rich: A No-Fail Plan for Achieving Financial Freedom at Any Age”, which I picked up at http://www.bookins.com, my favorite used-book swapping site (I hope he’d approve of my frugality in using book-swapping sites!). I wish more potential homeowners would have read his advice before assuming mortgages they now claim they didn’t understand!

Mistake #3 is soooo huge! There is no reason you shouldn’t start saving in an IRA, 401K or otherwise once you have a steady job. And since the future of social security looks bleak, I don’t really know that creating personal savings for retirement is an option.

[...] If you’re not yet using your retirement account at work , go in to the office and sign up for your plan today. Make it a goal to save 10 percent or more of your gross income. If you can’t imagine saving 10 percent, start with 3 percent …Continue [...]

5 definite mistakes, but the story is supposedly for 10. Looks like not being able to count could also be a mistake!