Financial entitlement is one domain of financial exploitation. In 2010 Conrad and colleagues defined financial entitlement as: a belief held primarily by adult children that they can take their older parent(s)’ money to spend on themselves without permission. Although some adult children argue that the money is their inheritance and thus already earmarked for them, using an older person’s money without permission is exploitation.

The post Preventing financial exploitation of older adults appeared first on OUPblog.

By Irina A. Telyukova

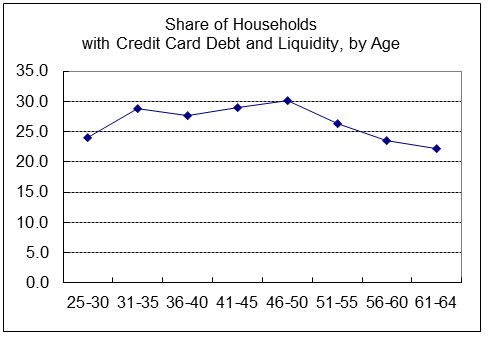

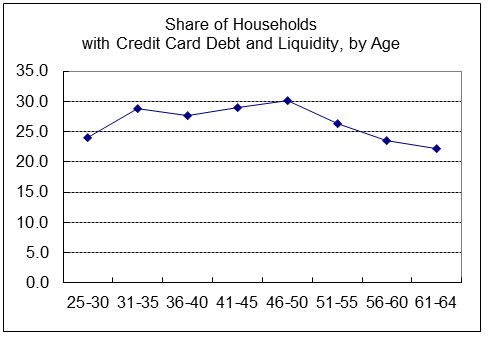

In the United States, around 25% of households tend have a substantial amount of expensive credit card debt that they carry over multiple months or even years, while also holding significant liquid assets, i.e. balances in checking and savings accounts.

For example, in 2001 data, such households paid an average 14% interest rate on the credit card, while earning nearly no return on the bank accounts. A median such household had $3800 in credit card debt, and $3000 in the bank. The average amounts were about $5800 and $7200, respectively. This behavior is quite persistent with age, as the picture below shows. It is also persistent over time, at least over the last two decades. The statistics for 2010 are very close to those for 2001.

It may seem that given the cost of revolving credit card debt, people should pay it off if they have any money in the bank. Hence, the phenomenon has been termed the “credit card debt puzzle”. Much of the discussion of it in the literature interpreted it as evidence that people lack self-control, or that they lack the financial sophistication to plan properly. In my study, I instead focused on a more familiar idea: that people hold on to money in the bank because they may need it for expenses for which credit cannot be used, and such expenses could be large and unexpected. Not only do we pay our rents and mortgages still largely by check or electronic payment from the bank, but if we have a large car or home repair to take care of, the contractor might give preferential pricing to a cash payment or simply not accept credit cards. Indeed I find that homeowners are more likely to simultaneously have debt and money in the bank, and that home repairs are an important source of large and unpredictable expenses for most households. Then, even if a household has credit card debt, it may not be optimal to draw down the bank account to zero to repay the debt. Incidentally, this idea has been advanced in the past by those who have studied the same behavior on the side of firms.

The story is intuitive; the difficult part is measuring how well this explanation can account for the puzzle, because we do not have good data on how people pay for things during a typical month, and because it is difficult to disentangle which expenses are unpredictable. Nevertheless, using several household surveys and a model of household portfolio choice, I measured both typical monthly liquid expenses (i.e. those done by cash, check, debit and other ways that require the bank account to have a positive balance), and the extent of uncertainty in them. I find that for the median person, there appears to be enough uncertainty to warrant holding on the order of $3,000 of liquid assets, even if she has credit card debt as well. In other words, many people who simultaneously have credit card debt and money in the bank are behaving without violation of self-control or rationality, under the constraint that they do not have enough money both to pay off their debt and attend to their expected monthly expense needs.

The story is intuitive; the difficult part is measuring how well this explanation can account for the puzzle, because we do not have good data on how people pay for things during a typical month, and because it is difficult to disentangle which expenses are unpredictable. Nevertheless, using several household surveys and a model of household portfolio choice, I measured both typical monthly liquid expenses (i.e. those done by cash, check, debit and other ways that require the bank account to have a positive balance), and the extent of uncertainty in them. I find that for the median person, there appears to be enough uncertainty to warrant holding on the order of $3,000 of liquid assets, even if she has credit card debt as well. In other words, many people who simultaneously have credit card debt and money in the bank are behaving without violation of self-control or rationality, under the constraint that they do not have enough money both to pay off their debt and attend to their expected monthly expense needs.

While the story accounts for the median amount of money held in the bank by those who also have credit card debt, the average household has a lot more money in the bank, and more money than credit card debt. This means that there are people who have very large amounts of liquid assets while still revolving credit card debt. While such households may face more severe risks than the average case that I measured, and while some may hold money in the bank because they foresee a possibility of a job loss and want to be able to pay at least their average expenses, it does suggest that some people may be able to improve their financial positions by examining their bank and credit card balances, and the interest costs that they pay on the credit card debt, to see if they can pay off some of their debt using their money in the bank.

Irina A. Telyukova is an assistant professor of economics at the University of California, San Diego. Her research focuses on different aspects of household saving. She has several publications on credit card debt and money demand. Her current research is about the use of home equity in retirement, in the United States and across countries, including a study about reverse mortgages. She is the author of the paper ‘Household Need for Liquidity and the Credit Card Debt Puzzle’, which appears in The Review of Economic Studies.

The Review of Economic Studies aims to encourage research in theoretical and applied economics, especially by young economists. It is widely recognised as one of the core top-five economics journal, with a reputation for publishing path-breaking papers, and is essential reading for economists.

Subscribe to the OUPblog via email or RSS.

Subscribe to only business and economics articles on the OUPblog via email or RSS.

Image Credits: (1) Graph produced by the author. Do not reproduce without permission. (2) Credit Card. By Gökhan ARICI, iStockphoto

The post Why don’t people pay off credit card debt? appeared first on OUPblog.

By Beverley Hunt

With just over a week to go until Christmas, many of us are no doubt looking forward to the holidays and a few days off work. For those working on the first edition of the Oxford English Dictionary, however, writing the history of the language sometimes took precedence over a Christmas break.

Christmas leave in the UK today centres around a number of bank holidays, so called because they are days when, traditionally, banks closed for business. Before 1834, the Bank of England recognized about 33 religious festivals but this was reduced to just four in 1834 – Good Friday, 1 May, 1 November, and Christmas Day. It was the Bank Holidays Act of 1871 that saw bank holidays officially introduced for the first time. These designated four holidays in England, Wales, and Northern Ireland — Easter Monday, Whit Monday, the first Monday in August, and Boxing Day. Good Friday and Christmas Day were seen as traditional days of rest so did not need to be included in the Act. Scotland was granted five days of holiday — New Year’s Day, Good Friday, the first Monday in May, the first Monday in August, and Christmas Day.

So when James Murray took over as editor of the OED in 1879, Christmas Day was an accepted holiday across the whole of the UK, Boxing Day a bank holiday everywhere except Scotland, and New Year’s Day a bank holiday only in Scotland. Yet this didn’t stop editors and contributors toiling away on dictionary work on all three of those dates.

At Christmas play and make good cheer

Here is the first page of a lengthy letter to James Murray from fellow philologist Walter Skeat, written on Christmas Day, 1905. Skeat does at least start his letter with some seasonal greetings and sign off “in haste”, but talks at length about the word pillion in between! There are at least two other letters in the OED archives written on Christmas Day – a letter from W. Boyd-Dawkins in 1883 about the word aphanozygous (apparently the cheekbones being invisible when the skull is viewed from above, who knew?), and another from R.C.A. Prior about croquet in 1892.

Boxing clever

Written on Boxing Day, 1891, this letter to James Murray is from Richard Oliver Heslop, author of Northumberland Words. After an exchange of festive pleasantries, Oliver Heslop writes about the word corb as a possible misuse for the basket known as a corf, clearly a pressing issue whilst eating turkey leftovers! Many other Boxing Day letters reside in the OED archives, amongst them a 1932 letter to OUP’s Kenneth Sisam from editor William Craigie concerning potential honours in the New Year Honours list following completion of the supplement to the OED.

Out with the old, in with the new

Speaking of New Year, here is a “useless” letter to James Murray from OUP’s Printer Horace Hart, written on New Year’s Day, 1886. Although not an official holiday in Oxford at that time, this letter provides a nice opportunity for discussing the etymology of the term Boxing Day. The first weekday after Christmas Day became known as Boxing Day as it was the day when postmen, errand-boys, and servants of various kinds expected to receive a Christmas box as a monetary reward for their services during the previous year. This letter talks about baksheesh, a word used in parts of Asia for a gratuity or tip.

Holidays are coming

In case you’re wondering, New Year’s Day was granted as an additional bank holiday in England, Wales, and Northern Ireland in 1974, as was Boxing Day in Scotland (and 2 January from 1973). So the whole of the UK now gets all three as official days of leave in which to enjoy the festive season.

This article originally appeared on the OxfordWords blog.

Beverley Hunt is Archivist for the Oxford English Dictionary but will not be archiving on Christmas Day, Boxing Day, or New Year’s Day.

If you’re feeling inspired by the words featured in today’s blog post, why not take some time to explore OED Online? Most UK public libraries offer free access to OED Online from your home computer using just your library card number. If you are in the US, why not give the gift of language to a loved-one this holiday season? We’re offering a 20% discount on all new gift subscriptions to the OED to all customers residing in the Americas.

Subscribe to the OUPblog via email or RSS.

Subscribe to only language, lexicography, word, etymology, and dictionary articles on the OUPblog via email or RSS.

Subscribe to the OxfordWords blog via RSS.

The post Don’t bank on it appeared first on OUPblog.

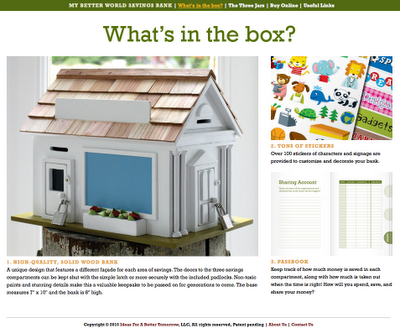

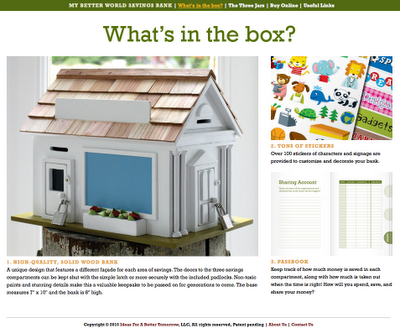

Last year, I worked on a fun project called My Better World Savings Bank. It is a high quality wooden house bank that has three compartments, and it teaches kids about spending, saving, and sharing. It comes with tons of stickers to decorate the house with and a passbook to keep track of expenses.

Last year, I worked on a fun project called My Better World Savings Bank. It is a high quality wooden house bank that has three compartments, and it teaches kids about spending, saving, and sharing. It comes with tons of stickers to decorate the house with and a passbook to keep track of expenses.

Along with founder John Weatherley and designer Alex Knowlton, I illustrated the stickers and the art work for the site. You can buy the bank online or check out some useful links to teach children to be financially smart!

Dexigner.com is an online Eurpean Illustrators forum and gallery.

What a great idea!

That really is a great idea. I'm still struggling with finances (part of which might be a fact that I'm an illustrator and don't make much money :) ).

Fantastic idea! This would make a great gift!!

I just saw your work on PInng. Just amazing!! I'm an illustrator too. I love your new bank... I have to get one for my kids:)

Thanks for the comment. so cool that you've seen my work in Target. Happy friday!!

This is a great idea for kids. You did wonderful graphics. I would love those stickers! Nice work, Jannie ;)