new posts in all blogs

Viewing: Blog Posts Tagged with: SFG: Rock Legends, Most Recent at Top [Help]

Results 1 - 10 of 10

How to use this Page

You are viewing the most recent posts tagged with the words: SFG: Rock Legends in the JacketFlap blog reader. What is a tag? Think of a tag as a keyword or category label. Tags can both help you find posts on JacketFlap.com as well as provide an easy way for you to "remember" and classify posts for later recall. Try adding a tag yourself by clicking "Add a tag" below a post's header. Scroll down through the list of Recent Posts in the left column and click on a post title that sounds interesting. You can view all posts from a specific blog by clicking the Blog name in the right column, or you can click a 'More Posts from this Blog' link in any individual post.

By: Alice,

on 2/4/2013

Blog:

OUPblog

(

Login to Add to MyJacketFlap)

JacketFlap tags:

George W. Bush,

Current Affairs,

income,

taxpayers,

zelinsky,

Edward Zelinsky,

President Obama,

estate,

incomes,

*Featured,

origins of the ownership society,

Business & Economics,

How The Defined Contribution Paradigm Changed America,

American Taxpayer Relief Act of 2012,

capital gains tax,

high income taxpayers,

income tax law,

tax reductions,

dividends,

gains,

permanently,

Add a tag

By Edward Zelinsky

The American Taxpayer Relief Act of 2012 is widely understood as a victory for President Obama. However, the long-term story is more complicated than this. The Act in large measure confirms in bi-partisan fashion the tax-cutting priorities of George W. Bush.

In the Act, President Obama achieved his proclaimed goal of increasing income taxes on the country’s most affluent taxpayers through higher income tax rates and reduced deductions. The Act creates a new 39.5% income tax bracket for individuals with taxable incomes above $400,000 and for married couples filing jointly with taxable incomes above $450,000. It phases out personal exemptions for individuals with adjusted gross incomes over $250,000 and for married couples with adjusted gross incomes over $300,000. It also reduces itemized deductions for these affluent taxpayers.

For high income taxpayers, the Act increases the maximum capital gains tax rate from 15% to 20%. When combined with the new Medicare tax on investment income, this results in a combined tax of 23.8 % on capital gains for the highest income taxpayers.

It is thus unsurprising that the Act has been heralded as a triumph for Mr. Obama and his vision of a more progressive income tax law.

However, the reality is more complex than this. For the long run, the winner under the Act was Mr. Obama’s predecessor, George W. Bush. The Act, as it gave Mr. Obama some of what he wanted, also made permanent much of what Mr. Bush desired as a matter of tax policy. Indeed, as a result of the Act, federal taxes are in important measure now permanently at the lower levels where President Bush wanted them.

The vast majority of Americans are not affected by the Act’s changes for the highest income taxpayers. For most taxpayers, the Act thus permanently ratifies the lower federal income tax rates championed by Mr. Bush in 2001. Moreover, the Act confirms that corporate dividends will be taxed at lower capital gains rates rather than as ordinary income. True: capital gains rates are now higher for the most affluent of taxpayers as a result of the Act. However, even at these higher rates, taxing dividends as capital gains, rather than as regular income, significantly reduces the tax burden on such dividends.

Consider, moreover, the federal estate tax. When President Bush took office in 2001, the federal estate tax applied to estates over $675,000. That floor was scheduled to increase in stages to $1,000,000. The maximum federal estate tax rate was then 55%.

While President Bush did not succeed in abolishing the federal estate tax, the Act provides that federal estate taxation will only apply to estates over $5,000,000 adjusted for increases in the cost of living. For 2013, an estate must be over $5,250,000 to trigger federal estate taxation. When it applies, the estate tax will be levied at a flat rate of 40%.

In the area of tax policy, President Bush did not achieve all he sought. No president does. If we define success more realistically, the 2012 Act confirms President Bush’s triumph in permanently lowering federal income tax rates for most Americans, reducing the effective tax burden on corporate dividends, and significantly reducing the reach of the federal estate tax.

To some, these tax reductions are welcome restraints on the federal leviathan. To others, the Bush tax reductions, now permanent, regrettably hamper the federal fisc. What cannot be doubted is that the Internal Revenue Code we have today in large measure reflects the tax-cutting priorities of George W. Bush. In adopting the Act, a Democratic President and Senate, along with a Republican House, permanently confirmed much of these tax-reducing priorities.

Edward A. Zelinsky is the Morris and Annie Trachman Professor of Law at the Benjamin N. Cardozo School of Law of Yeshiva University. He is the author of The Origins of the Ownership Society: How The Defined Contribution Paradigm Changed America. His monthly column appears on the OUPblog.

Edward A. Zelinsky is the Morris and Annie Trachman Professor of Law at the Benjamin N. Cardozo School of Law of Yeshiva University. He is the author of The Origins of the Ownership Society: How The Defined Contribution Paradigm Changed America. His monthly column appears on the OUPblog.

Subscribe to the OUPblog via email or RSS.

Subscribe to only business and economics articles on OUPblog via email or RSS.

The post And the winner is… George W. Bush appeared first on OUPblog.

By: Alice,

on 1/31/2013

Blog:

OUPblog

(

Login to Add to MyJacketFlap)

JacketFlap tags:

Current Affairs,

markets,

banking,

taxpayers,

credit crunch,

banks,

shareholders,

*Featured,

Law & Politics,

Business & Economics,

LIBOR,

European Monetary mechanism,

Financial Markets and Exchanges Law,

George Walker,

investment markets,

Michael Blair QC,

public backlash,

Stuart Willey,

Vickers reforms,

willey,

Add a tag

By Michael Blair QC, George Walker, and Stuart Willey

Almost every day has brought a fresh story about investment markets, their strengths and weaknesses. Misreporting of data for calculation of LIBOR, money laundering with a whiff of Central American drugs trading, costly malfunctioning of programme trading mechanisms which brought the trading company to its knees, reputational damage inflicted by as yet unsubstantiated accusations of illicit financing in breach of international sanctions… the list goes on and on.

Toronto Financial District. Photo by Alessio Bragadini, 23 June 2009. Creative Commons License.

And this has all been on top of the recent history of the so-called

credit crunch and the self-inflicted wounds that have beset the banking industry over the last five years, with consequentially a savage public backlash of distrust and dislike of bankers and banks. This has affected the banking fraternity as a whole, even though those that caused the damage to their banks, to the shareholders and in the end to the taxpayers, were a small sub-set only of the banking workforce.

The list of problems, for firms, and in some cases for their customers as well, prompts some reflections about the role of investment markets in our society and about the relationship between markets and their regulation. Some years ago, in the latter part of the last century, it was fashionable for academics and practitioners alike to put their trust in the strength and reliability of market mechanisms. The experience in earlier decades of the hard discipline of the money markets no doubt added to this. For example the humiliation of the forced departure of the United Kingdom from the former European Monetary mechanism (EMU) in the 1980s reinforced the beliefs of many in the power of the markets as a way of finding and pricing out inefficiency and restoring a new equilibrium at a different point on the scale.

To the majority, therefore, the proper role of regulation at that time was essentially limited to cases of market failure. Most of the work in the public interest could be done by the markets themselves. They might, of course, need some help from the regulators to ensure proper disclosure, with a view to sufficient, and non-discriminatory, access by market users and commentators to market information. But if there was “sunlight” in the market, then that more or less guaranteed the “hygiene” of its mechanisms. From that concept came “light touch” as a means of describing a system of financial regulation that basically left it to well informed markets to function for themselves.

Not all agreed at the time with this general approach. There were honourable exceptions, whose only consolation since has been the (frequently best left unsaid) phrase “I told you so at the time”.

How things have changed since then! A rapid U-turn in public and political thinking has brought demands for sterner and more intrusive regulation. The insidiousness of human greed and of lack of foresight is now widely recognised and needs to be restrained. The market economists now accept that there is a real, and central, role for discipline, including both its punitive and its deterrent aspects as well as the benefits it brings in excluding the dangerous from the playing field altogether. The change has even led our politicians to embark on structural change to restore a previous splitting of retail regulation from the upper reaches of financial services. The case for this change has been based on a hope of better focus of the two new bodies on the two sectors, though the underlying motive appears more to be a desire to change something simply because it is thought to have failed.

Splitting in the public interest also seems likely to be required in the major banks as well. The “Vickers” reforms look set to require the banking industry to function in two separate ways, with required distance between the investment banking arms and the general consumer-based borrowing and lending functions.

Another consequence is that “enforcement” is once more central to the world of regulation, rather than seen as a stick kept, as far as was possible, in the cupboard for occasional use only in the most serious circumstances.

We have now arrived at a new post-crisis period of great challenge but also of potential opportunity. We seem to be set for a number of difficult coming years, during which the markets will be dominated and constrained by austerity, continuing uncertainty and risks of instability. But markets and economies tend to recover over time. We must hope that the politicians, central banks and regulatory authorities have learned all of the necessary lessons from the recent crises to prevent instability or, at least, better to manage and contain the risks of it.

Michael Blair QC, Professor George Walker, and Stuart Willey are the editors of the new edition of Financial Markets and Exchanges Law. Michael Blair QC is in independent practice at the Bar of England and Wales specialising in financial services. Previously General Counsel to the Board of the Financial Services Authority. Queen’s Counsel honoris causa 1996. George Walker is Professor in International Financial Law at School of Law, Queen Mary University of London and is a member of the Centre for Commercial Law Studies (CCLS). He is also a Barrister and Member of the Honourable Society of Inner Temple in London. Stuart Willey is Counsel and Head of the Regulatory Practice in the Banking & Capital Markets group of White & Case in London. Stuart specializes in financial regulation focusing on the securities markets, banking and insurance.

Subscribe to the OUPblog via email or RSS.

Subscribe to only law and politics articles on the OUPblog via email or RSS.

The post Understanding and respecting markets appeared first on OUPblog.

By: Alice,

on 3/5/2012

Blog:

OUPblog

(

Login to Add to MyJacketFlap)

JacketFlap tags:

*Featured,

origins of the ownership society,

Business & Economics,

equity,

Ben Bernanke,

Federal Reserve,

K.J. Martijn Cremers,

Private Equity,

Public Pensions,

Steven Kaplan,

cremers,

Current Affairs,

taxpayers,

pension,

returns,

Edward Zelinsky,

investments,

bernanke,

Add a tag

By Edward Zelinsky

Public pension plans should not invest in private equity deals. These deals lack both transparency and the discipline of market forces. Private equity investments allow elected officials to assume unrealistically high rates of return for public pension plans and to make correspondingly low contributions to such plans. This is a recipe for inadequately funded pensions, an outcome good for neither public employees nor taxpayers.

Ben Bernanke. Source: United States Federal Reserve.

Testifying recently before the House Committee on Financial Services, Federal Reserve Chairman Ben Bernanke confirmed that short-term interest rates will effectively be kept at zero for the near future. This comes as no surprise to the millions of Americans who today receive nonexistent returns on their passbook savings and money market accounts.

In this low return environment, public defined benefit pension plans generally assume that they can earn annual investment returns in the vicinity of 8%. Such aggressive return assumptions allow governors and legislators to authorize smaller tax-financed contributions to such public pensions on the theory that anticipated investment gains will fund the retirement benefits promised to public employees.

A primary defense of this practice is that plans’ assumptions should reflect long-term experience. From this vantage, the current low interest rate environment is an historic anomaly. For the long run, the argument goes, public pension plans will earn higher returns.

Whatever the theoretical merits of this approach, it is troubling in practice, an invitation to push into the future the problem of inadequately funded public pension plans. That problem exists today and needs to be confronted today, as the Baby Boomer cohort retires in unprecedented numbers and places corresponding demands on public and private retirement plans.

A second defense of high assumed rates of return is that public pension plans can earn aggressive gains through so-called “alternative” investments such as private equity partnerships. Publicity about Mitt Romney’s IRA has focused attention on the often lucrative results obtained by at least some private equity investors. Many public pension plans have effectively become addicted to private equity deals and their promises of outsized investment returns.

It is, however, doubtful that these promised returns are generally obtained by the private equity industry or that such returns are obtained on the scale sought by public pension plans. Private equity is, by definition, private. Much of the good news we hear about this industry comes from the industry itself. Since there are no active markets for these investments, investors in private equity deals are ultimately dependent upon valuations by the sponsors of these deals.

In a recent paper, Professor K.J. Martijn Cremers of the Yale School of Management concluded that private equity investors have in the last 10 years done no better than investors in the stock market. Others, such as Professor Steven Kaplan of th

By: Lauren,

on 11/1/2010

Blog:

OUPblog

(

Login to Add to MyJacketFlap)

JacketFlap tags:

microsoft,

millionaire,

taxes,

Featured,

Finance,

taxpayers,

bill gates,

washington state,

billionaire,

Edward Zelinsky,

gates,

Gates Foundation,

foundation,

U.S. Treasury,

billionaires,

incomes,

millionaires,

exempt,

Law,

Business,

Add a tag

Dear Mr. Gates:

You have, by dint of your intelligence and sincerity, become a major spokesman for wealthy Americans calling for higher taxes. Since the nation’s budgetary problems will only be solved by combining spending reductions with tax increases, this is a compelling claim.

However, the devil, as they say, is in the details. Allow me to call three details to your attention:

1) Microsoft’s tax avoidance. Microsoft has become increasingly adept at parking its profits in low tax foreign jurisdictions, rather than paying U.S. taxes. After analyzing Microsoft’s financial statements, Tax Analysts’ Martin A. Sullivan recently concluded that Microsoft “has dramatically stepped up its efforts to take advantage of lax U.S. transfer pricing rules.” In lay terms, Microsoft is avoiding U.S. taxes by accounting maneuvers which shift its profits to low tax havens.

Of course, Microsoft is not alone in this behavior. However, Microsoft is the source of your family’s wealth and influence. I suggest that you start a campaign to press U.S. corporations to pay U.S. taxes and that you lead with Microsoft as the campaign’s first target.

2) Millionaires and billionaires are different. You are the leading proponent of the plan to establish an income tax in Washington State. The tax will be levied at a rate of 5% on annual incomes over $200,000 ($400,000 for couples). The rate will increase to 9% on annual incomes over $500,000 ($1,000,000 for couples).

Individuals earning these kinds of incomes are undoubtedly affluent. But few of them are software billionaires. Unfortunately, the Washington State levy will tax millionaires and billionaires at the same rates.

Many individuals triggering the first tier of the Washington income tax will be professionals like me. Many of the individuals triggering the higher tax level will be small businessmen and businesswomen. As to this latter group, the Washington tax will be among the nation’s highest. For these people, the tax will impose a noticeable burden and could lead to economic distortions such as a decision to leave Washington for a state with a low or no income tax.

It is neither fair nor efficient for the billionaires of Microsoft to pay the same marginal tax rates as these other taxpayers.

I suggest that you call for a third, substantially higher rate for the Washington State tax to apply to individuals such as you. The resulting revenues would permit a reduction of the rates applying to other, less affluent Washington State taxpayers.

3) The Gates Foundation is a tax shelter. The Gates Foundation does great work of which you and your family can be justifiably proud. But there is one thing the Gates Foundation doesn’t do: pay taxes.

You and your son have both been outspoken proponents of federal estate taxation. However, the resources you and he contribute to the Gates Foundation avoid such taxation. Moreover, the foundation, as a tax-exempt entity, pays no federal income tax.

I understand and applaud the charitable impulse which animates the Gates Foundation. My wife and I have established a private foundation in memory of our son though this fund is, needless to say, much smaller than the Gates Foundation.

It is, nevertheless, problematic to call for others to pay higher estate and income taxes while the Gates Foundation, one of the country’s largest, effectively shelters your and your son’s incomes and estates from the federal fisc.

I urge that the Gates Foundation annually and voluntarily

By: Rebecca,

on 4/9/2008

Blog:

OUPblog

(

Login to Add to MyJacketFlap)

JacketFlap tags:

Law,

Politics,

Current Events,

A-Featured,

Hillary Clinton,

clinton,

Finance,

income,

President Clinton,

tax,

tax return,

wealth,

subsidy,

taxable,

clintons’,

taxpayers,

clinton’s,

package,

taxpayer,

return,

Add a tag

Edward A. Zelinsky is the Morris and Annie Trachman Professor of Law at the Benjamin N. Cardozo School of Law of Yeshiva University. He is the author of The Origins of the Ownership Society: How The Defined Contribution Paradigm Changed America. In the article below he looks at the Clinton’s federal tax returns.

President and Senator Clinton’s federal tax returns provide much fodder for commentators who are debating a diverse set of questions in light of those returns: Has Mr. Clinton understandably maximized his post-presidential income in our celebrity-crazed culture – or has he exploited the presidency for unseemly financial gain? Does the Clintons’ private foundation reflect a worthy model of charitable giving – or the federal fisc’s subsidization of Senator Clinton’s presidential candidacy? Was Mr. Clinton financial relationship with Yucaipa appropriate for a former president – or for the spouse of a prospective president?

The Clintons’ tax returns raise one further issue which also requires public discussion: The federal subsidy the Clintons have received over the last seven years while earning in excess of $100 million. Mr. Clinton’s aggressive pursuit of post-presidential income is incompatible with the extensive public support he has received from federal taxpayers since leaving office. That public support was designed to preclude the nation’s chief executives from facing financial hardship after their terms of office. It was not intended to subsidize the aggressive pursuit of a post-presidential fortune.

the extensive public support he has received from federal taxpayers since leaving office. That public support was designed to preclude the nation’s chief executives from facing financial hardship after their terms of office. It was not intended to subsidize the aggressive pursuit of a post-presidential fortune.

The federal taxpayer’s subsidy of Mr. Clinton has several components. First, as a former president, Mr. Clinton is entitled to receive, for the remainder of his life, the salary of a cabinet secretary. That salary is today $191,000 per annum. In addition, as a former president, Mr. Clinton also receives, at taxpayer expense, “suitable office space appropriately furnished and equipped.” Mr. Clinton’s office in New York City costs federal taxpayers over $700,000 per year to lease and operate. Federal taxpayers also defray the salary and benefits for office staff and some of Mr. Clinton’s travel outlays. The General Services Administration currently budgets for all of these costs a yearly total of $1,162,000 for Mr. Clinton. The equivalent annual figures for former President Bush and former President Carter are $786,000 and $518,000 respectively.

In addition, Mr. Clinton is also entitled, at taxpayer expense, to Secret Service protection for the remainder of his lifetime – even though, as president, Mr. Clinton signed legislation limiting Secret Service protection for his successors to the first ten years after they leave office.

For most Americans, Mr. Clinton’s package would constitute a heady lifestyle. For President and Senator Clinton, however, this post-presidential package merely provided a tax-financed base for the aggressive pursuit of unprecedented financial gain for a former chief executive.

Mr. Clinton has apparently treated as tax-free much of the federal largesse he has received. While the Clintons’ federal tax returns report as taxable income his cabinet-level salary payments, he has apparently elected to exclude from his taxable income the other benefits he receives, namely, his federally-financed office, staff, travel costs and protection.

If the Clintons had treated these items as taxable, they most likely would have been reported on their Forms 1040 on line 21 for “other income”. On the Clintons’ 1040 for 2006, line 21 is blank, suggesting that they did not include in income the office, staff, travel costs or protection provided to them by federal taxpayers.

The tax-free treatment of this federal subsidy of Mr. Clinton makes it particularly valuable for him.

This post-presidential package and the federal subsidy it represents were not intended as a conventional deferred compensation arrangement. They instead reflect the judgment that former presidents should not be required to hustle in the marketplace after they leave office.

The story of an impoverished Ulysses Grant, financially-impelled to write his memoirs as he was dying of cancer, is an iconic image of American history. From this tragedy, the world received one of the great military autobiographies of all time. However, most Americans would prefer that the nation’s former leaders not confront the kind penury which plagued Grant at the end of his life.

The immediate stimulus for the modern post-presidential compensation package was the report that former president Truman lacked the resources to return his mail from the American public.

This post-presidential package was designed to preclude Grant’s and Truman’s successors from experiencing the financial problems they confronted. It was not intended to serve as a federal subsidy for the aggressive pursuit of a post-presidential fortune.

President Clinton is not required to accept all or any of the proffered subsidy from the federal Treasury. He can also make a payment to the federal fisc reimbursing it, in whole or in part, for the costs of this subsidy. Such reimbursement could, for example, be geared to the taxes Mr. Clinton would pay if his post-presidential benefits were treated as taxable income.

The federal taxpayers provide post-presidential benefits so that former chief executives will not replicate the unfortunate financial history of Grant or even the more moderate financial discomfort in which President Truman found himself. We do not subsidize former presidents so that they may pursue lucrative private sector careers. As a federal taxpayer subsidizing Mr. Clinton’s lifestyle, I hope he feels my pain.

ShareThis

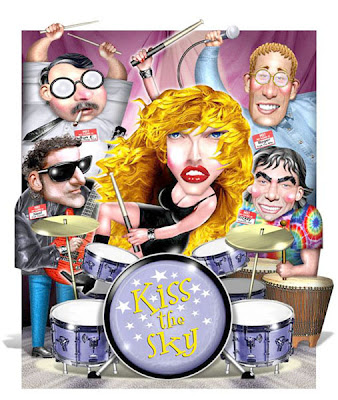

This was commissioned for Brian May's (Queen) appearance on the British radio programme 'Desert Island Disks' a few years ago. I got a call afterwards from his office asking to buy the original, asking I signed it 'To Brian'. I actually painted him a copy, but he wrote back; 'Just a note to say THANK YOU so much for the wonderful painting- my admiration of your skills knows no bounds- I really appreciate this great treasure and will immediately put it on my wall! Cheers Brian', enclosing a signed print of the painting along with his latest CD. Though I've occasionally sold work to other people, this is my favourite story. It's rare to actually hear what they think of my work.

This was commissioned for Brian May's (Queen) appearance on the British radio programme 'Desert Island Disks' a few years ago. I got a call afterwards from his office asking to buy the original, asking I signed it 'To Brian'. I actually painted him a copy, but he wrote back; 'Just a note to say THANK YOU so much for the wonderful painting- my admiration of your skills knows no bounds- I really appreciate this great treasure and will immediately put it on my wall! Cheers Brian', enclosing a signed print of the painting along with his latest CD. Though I've occasionally sold work to other people, this is my favourite story. It's rare to actually hear what they think of my work.

My website

My (temporarily suspended) Blog

Two of the greatest and most prolific drummers in the history of rock and roll are also two of the biggest unsung heroes.

Hal Blaine and Jim Gordon played with some of the most famous performers in popular music and played on some of the most significant recordings in modern music history. Hal Blaine, a member of the famed LA session group The Wrecking Crew, holds a current Grammy record. He played on six consecutive Records of the Year: Herb Alpert & the Tijuana Brass in 1966, for A Taste of Honey, Frank Sinatra in 1967, for Strangers in the Night, 5th Dimension in 1968, for Up, Up and Away, Simon & Garfunkel in 1969, for Mrs. Robinson, 5th Dimension in 1970, for Aquarius/Let the Sunshine In and Simon & Garfunkel in 1971 for Bridge Over Troubled Water. In addition, he played on recordings by everyone from The Partridge Family, Elvis Presley, The Carpenters, The Mamas and Papas, Neil Diamond, Barbra Streisand, The Byrds and Paul Revere & The Raiders. He was heard on the majority of The Beach Boys recordings (except for Pet Sounds, which was Jim Gordon. Dennis Wilson, the Beach Boys drummer, only drummed in concert). When Dennis Wilson recorded his only solo album, he hired Blaine to play drums. Blaine was inducted into the Rock and Roll Hall of Fame in 2000. He estimates that, in his career, he played on over 35,000 recordings.

Jim Gordon was one of the most sought-after session drummers throughout the 60s and 70s. He played alongside such artists as Donovan, Jackson Browne, Glen Campbell, Alice Cooper, Crosby, Stills, Nash & Young, George Harrison, The Monkees, Carly Simon, Steely Dan and Traffic. He played the famous drum break in the Incredible Bongo Band's "Apache", later sampled by The Sugarhill Gang in their hip-hop version of the song. Gordon was a member of Frank Zappa's Grand Wazoo band and he was the drummer for Eric Clapton's Derek and The Dominos. Gordon wrote and played the renowned piano outro on "Layla".

In 1983, after years of complaining of voices in his head, Gordon beat his mother with a hammer and stabbed her to death with a butcher knife. Gordon currently resides in a state medical corrections facility in Vacaville, CA

I couldn't resist.

This week's theme: SFG: Rock Legends

Kiss, Meatloaf, Ozzy and so on....this week's theme was enthusiastically suggested by Darren Di Lieto, the mastermind behind The Little Chimp Society,GIMUR.net, PIXELPRESENCE.net, MailMeArt.com and probably more that I'm not even aware of.

The SFG Challenge runs Thursday to Thursday, and was created to offer every member an opportunity to stretch their creative muscles and post their interpretations on a specific theme.

Be sure to label your illustrations with the appropriate labels as well. Label your entries with your name and the challenge label, in this case SFG: Rock Legends

Remember, this is a completely voluntary challenge designed solely to stimulate creativity and promote participation. Please don't hesitate to post your other work as normal.

There are some updates on the SFG Blank Book site if you haven't checked that out recently. Everyone involved so far looks like they're having a blast with it. The book has just left Vincent Altamore (and Jake) and is finding it's way to Gary Fields. Check out the great photos and teaser images at sfgblankbook.com!

The next challenge begins Thursday, October 4th, 2007.

Have a great week SFG'ers!

-Jeff

Edward A. Zelinsky is the Morris and Annie Trachman Professor of Law at the Benjamin N. Cardozo School of Law of Yeshiva University. He is the author of The Origins of the Ownership Society: How The Defined Contribution Paradigm Changed America. His monthly column appears on the OUPblog.

very impressive