By Alexander M. Gelber

When tax incentives draw single women into the labour force, what activities do they sacrifice? Do they spend less time enjoying leisure? Do they cut back on household chores? Do they give up time with their children?

Over the past thirty years, US policymakers tried to increase participation of single mothers in the labour force by expanding the Earned Income Tax Credit and reforming the welfare system. One key motivation for reform was the perception that some single mothers were choosing to be idle and instead ought to contribute more productively to society by working. But did the policy reforms induce single mothers to shift from one productive activity – work at home – to another – work in the market? In a new paper published in the Review of Economic Studies, we find that the answer is “yes”: tax policy largely shifts single women between work at home and work in the market. Interestingly, however, when tax incentives draw them into the labour force, they may not cut much from their “quality time” with their children.

Remarkable patterns in the data suggest that tax policy had a very important effect on the labour supply and housework decisions of single women over this period. From the mid-1980s to the mid-to-late-1990s, the incentive to participate in the labour force greatly increased for single women with children relative to those without children. This was largely due to major expansions of the Earned Income Tax Credit—which transfers money to low-income single households only if they participate in the labor force—and cutbacks in welfare, both of which impacted low-income single women.

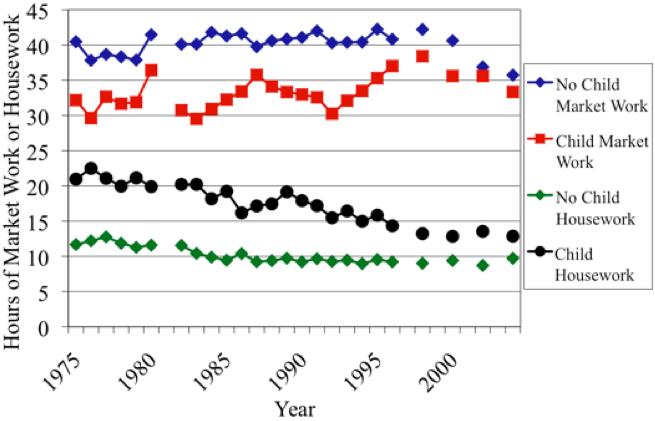

The figure below shows that over the same period of years, hours of market work for single women with children increased substantially relative to those without children, as previous literature has documented. This suggests that the changes in policy may have been responsible for the large changes in market work over the same period.

Strikingly, the pattern for housework looks like a mirror image of the pattern for market work. Hours of housework fell substantially for women with children relative to those without children over the period of the primary policy changes, with little relative change outside of this period. The relative fall in housework accounts for over half of the relative increase in market work, suggesting that most of the change in market work came out of housework. We find that for every additional hour that a single woman spends working in the market in response to a change in tax policy, she spends about 40 minutes less time working at home.

Mean usual hours of market work and housework of single women with and without children, 1975-2004

Importantly, we find no evidence that single women’s amount of time spent with children (as the primary activity, i.e. “quality time”) decreases significantly. We also find that single women’s time spent eating and preparing food decreases and that time spent sleeping changes insignificantly.

We find evidence that single women’s purchases of food away from home, such as takeout and restaurant meals, increase in response to an increase in the incentive to participate in the labour force. This makes sense: Women are busier when they enter the labour force and make up some of the time by purchasing food prepared by others instead of themselves. We also find some evidence that overall food purchases rise. Single women thus appear to use market goods to substitute for time: they become busier when they enter the labor force and save time by buying food in the market instead of themselves spending time on food.

Interestingly, howev