The following article was published February 21, 2012 by fivecentnickel.com.

Teens and Money

Written by Jeffrey Steele

The last 10 to 15 years have seen unprecedented numbers of Americans doing wacky things with their money, and paying big time for their mistakes.

About 12 years ago, for instance, a lot of folks bought into the tech bubble just before it became a tech wreck. Two years later, having seen their nesteggs decimated by the stock market plunge after dot.com went dot.bomb, many sold out of stocks in the trough, only to watch the markets suddenly rocket higher. Then, having licked their wounds and assembled a bit of cash, many couldn’t resist buying into housing at the top of that bubble, only to be wiped out again.

But why should such miscues be any surprise here in the good ol’ United States, where personal finance seems the most taboo of scholastic subjects?

I mean, this is a land where in our 12 years of elementary, middle, and high school, we learn obscure tidbits about the Magna Carta, far-out geometric algorithms, factoids about the flora and fauna of Tanzania, and other insights we’ll never use again, but are shut out of any kind of lessons on the one thing we’ll need to do every minute of the rest of our lives, which is manage money.

Those Awkward Years

No wonder the only group more prone to bonehead cash maneuvers than American adults is American teens. The University of California reported a few years ago that American teens were spending at about a $179 billion annual clip. Yet, when given a national standardized money management test, high school seniors tallied an average grade of 48.3 percent, a failing score.

“High school seniors have little knowledge of money management, savings, investments, income and spending,” the UC system reported. “A vast majority of students 16 to 22 have never taken a class in personal finance, with two-thirds admitting they could benefit from more money management lessons. Alarmingly, nine percent were rolling over credit card debt each month.”

Today, only nine states have any type of program to assess students’ financial literacy, and fewer than one in five teachers feels he or she is equipped to teach classes in financial literacy, according to a recent study by the President’s Advisory Council on Financial Capability.

That report found financial literacy on the part of both the population as a whole and on the part of teens was low, which may have to do with increasing legions of folks being “unbanked,” and having higher levels of indebtedness, as well as lower rates of wealth accumulation and financial planning.

I can certainly attest from personal experience to the comparative lack of personal financial skills by American teens. Why, I recall that as a teen-ager, my own main interest in life was blowing as much money as possible on eight-track tapes.

And this was in 2004.

New Initiative Needed

Just kidding, of course. But it’s clear we need a new initiative to tackle teen financial illiteracy. And it’s being provided by Amsco School Publications, Inc., a 75-year-old New York City-based family-owned company that publishes textbooks and supplementary materials for students in grades 7 through 12.

Amsco School Publications has recently created Personal Finance, a textbook designed to teach American teens what they need to know to live fiscally responsible lives. That includes setting financial goals, researching and planning careers, understanding banks, knowing where to save and invest, using credit wisely, and comprehending why insurance is needed, even at young ages.

I recently had a chance to talk to Amsco’s vice president of sales and marketing Irene Rubin, and asked her why her company decided to tackle teen literacy. “We knew there’s a problem, because of the credit card debt

Viewing: Blog Posts Tagged with: Financial Literacy, Most Recent at Top [Help]

Results 1 - 11 of 11

Blog: Amsco Extra! (Login to Add to MyJacketFlap)

JacketFlap tags: Amsco in the News, Financial Literacy, Personal Finance, Add a tag

Blog: Amsco Extra! (Login to Add to MyJacketFlap)

JacketFlap tags: E-book, Financial Literacy, Amsco in the News, Add a tag

Over the past few months, Amsco School Publications, Inc. has been mentioned in several national publications, blogs, and on educational Web sites. We think that our blog followers might be interesting to see what is being said about us.

E-Commerce News.com January 24, 2012

The iBooks Profitability Puzzle

By Erika Morphy

MacNewsWorld Part of the ECT News Network 01/24/12 5:00 AM PT

Apple's new iBooks textbook market saw lots of activity over the weekend as users downloaded 350,000 copies of books, according to Global Equities Research. If iBooks catches on in a big way, it'll certainly be profitable to Apple. But whether it will be a good deal for authors and publishers has yet to be determined.

Apple's (Nasdaq: AAPL) iBooks textbook initiative, launched just last week, has clearly struck a chord in the market. Ditto its accompanying textbook authoring tool, iBooks Author. Both have taken off at a significant pace, according to a report by Global Equities Research.

More than 350,000 textbooks have been downloaded via iBooks over the past three days. In addition, there have been more than 90,000 iBook Author downloads. iBook Author is a free authoring tool to create textbooks for Apple iBooks.

A Big Impact

The numbers seem to indicate many students and educators at least interested in seeing how Apple wants to break into the market. However, as the ramifications of the textbook store and authoring tool become clearer, some industry observers are having second thoughts as to whether this would be a good thing.

For starters, textbook publishers could find their margins squeezed, perhaps uncomfortably so. As Global Equities notes in its report, more than 50 percent of textbook industry revenues come from the sales of introductory books.

Then there is the lock-in for authors that use Apple's authoring tool. Migrating to other platforms is simply not an option, at least with this current platform.

Global Equities Analysis

Global Equities' initial take on how publishers will fare in the system is that they will in fact make more money selling an iBook textbook priced at US$14.99 versus a traditional printed textbook priced at $125.

That is because 50 percent of the textbook industry consists of used books, which deliver zero revenues to publishers. Also, the textbook supply chain is a complicated one, consisting of distributor, wholesaler, retailer and finally student. At each step the markup is between 8 percent to 15 percent, for a total of between 33 percent to 35 percent -- excluding actual distribution costs.

Conversely, the cost of an iBook production is 80 percent less than a print product. Global Equities declined to provide further details.

Some publishes of textbooks, though, disagree with Global Equities' assumptions, not to mention its math. Larry Beller, president of Amsco School Publications, told MacNewsWorld the firm has been offering its own e-books for roughly a year and a half. Pricing for the two products -- print and e-book -- must remain roughly the same in order to provide revenues for the authors, he said, which are compensated differently than authors of fiction or non-fiction books.

"With Apple's platform coming out we will have to rethink some of the numbers, but it won't be a significant difference. It can't be." He added that there is still an important print market for college students -- and especially elementary and high school students -- that won't go away even if this platform becomes popular.

An iOS-Only Tool

For others, the authoring tool is the one that raises the most concern. For instance, writers who use iBooks Author to write books they intend to sell may only distribute them through Apple's services.

"There is a lot about this tool that I don't think authors will realize at first," Br

Blog: Amsco Extra! (Login to Add to MyJacketFlap)

JacketFlap tags: Business, Social Studies, Money, E-book, Financial Literacy, Personal Finance, Add a tag

Do you know the difference between securities and a security deposit? Between a bull market and a bear market? Between forbearance and foreclosure? Do you know how to spot a Ponzi scheme? Or to calculate your net worth? Test your personal finance IQ by clicking here to take take our Interactive Quiz. If you find that your score is less than genius-level, you may want to brush up with Amsco's Personal Finance by Margaret Magnarelli, senior editor at Money magazine and a blogger on cnnmoney.com. If you are teaching Personal Finance, Business, Entrepreneurship, or Consumer Economics at the high school or community college level, you may want to add this book to your curriculum.

Personal Finance teaches students everything they need to know to do better financially, guiding them through the decision-making that will help them earn, save, invest, and protect their money throughout their lifetimes.

The author's approach engages students, asks them to connect to the subject matter, and challenges them with new concepts, while maintaining ease and readability. The book proceeds in a commonsense order:

Blog: Amsco Extra! (Login to Add to MyJacketFlap)

JacketFlap tags: Economics, Social Studies, E-book, Internet Resources, Financial Literacy, Personal Finance, Add a tag

About the Book

Personal Finance is a comprehensive book that provides all the necessary skills and knowledge a young adult needs to know about smart money management, and necessary life decisions involving money and expenses. This book is presented in an orderly and logical fashion, in an effort to bring financial literacy to many learning levels. It meets all personal finance voluntary national standards set out by the Jump$tart Coalition, and correlates to the financial literacy standards of many states. It is also a great addition to an Economics course that needs to meet financial literacy requirements, as a textbook for a Consumer Economics class, or as an addition to an introductory Business/Entrepreneurship course.

Personal Finance is made up of six chapters, a Glossary, Internet Resources, and an Index. Each chapter covers basic personal finance knowledge, from creating a budget, finding a job and thinking about a career, to using credit and loans, understanding insurance, and discussing financial investments and how they work.

Blog: Amsco Extra! (Login to Add to MyJacketFlap)

JacketFlap tags: Opinion, Economics, Culture, Financial Literacy, Personal Finance, Add a tag

After being completely overwhelmed by the amount of Christmas presents my two children received from our families (which I believe was relatively modest in comparison to the bounty many other kids received), my wife and I were inspired to watch What Would Jesus Buy?, a documentary on consumer culture in the U.S.

After being completely overwhelmed by the amount of Christmas presents my two children received from our families (which I believe was relatively modest in comparison to the bounty many other kids received), my wife and I were inspired to watch What Would Jesus Buy?, a documentary on consumer culture in the U.S.What Would Jesus Buy? follows the comedic, yet serious, Reverend Billy and his Church of Stop Stopping on a national tour, in which the Reverend (who is actually just a performer and protester, not an actual minister) attempts to spread the word—“Stop Shopping!” Reverend Billy’s ultimate concern is that we are using our time to shop, rather than to create, relax, or help others. To prove his case, Reverend Billy cites some frightening statistics: “26 million Americans are addicted to shopping, consumer credit debt is now $24 trillion dollars,” and there is enough retail shopping space in the U.S. for every person in North America, South America, and Europe to fit inside of a store at the same time.

Although I agree with Reverend Billy’s spiritual quest, I also think there is a very practical matter to be dealt with. How can Americans make smart consumer decisions in a country that is obsessed with fads, inundated with advertising, and bombarded with credit card offers (I think I throw away 2-3 credit offers per day!)? This is a question that politicians, nonprofit organizations, universities, and schools have also been grappling with in light of the recent Credit Card Accountability, Responsibility, and Disclosure Act. Considering that one Christmas shopper who was interviewed for WWJB? passionately declared, “I’m buying all these presents for my kids, I don’t care if go broke because it’s all for my kids,” it seems as though there are definitely people out there who could benefit from a course or workshop in personal finance.

Although I agree with Reverend Billy’s spiritual quest, I also think there is a very practical matter to be dealt with. How can Americans make smart consumer decisions in a country that is obsessed with fads, inundated with advertising, and bombarded with credit card offers (I think I throw away 2-3 credit offers per day!)? This is a question that politicians, nonprofit organizations, universities, and schools have also been grappling with in light of the recent Credit Card Accountability, Responsibility, and Disclosure Act. Considering that one Christmas shopper who was interviewed for WWJB? passionately declared, “I’m buying all these presents for my kids, I don’t care if go broke because it’s all for my kids,” it seems as though there are definitely people out there who could benefit from a course or workshop in personal finance. Recently,

Recently, Blog: First Book (Login to Add to MyJacketFlap)

JacketFlap tags: Philanthropy, First Book Events, Miami, financial literacy, Barclays Capital, Barclays, Bunny Money, Barclays Wealth, Add a tag

Last week, volunteers from Barclays Wealth and Barclays Capital surprised students at Southside Elementary Museums Magnet School in Miami, Florida with a donation of 2,000 brand new books. The volunteers shared a very special afternoon of reading with the first-grade students of Southside; children crowded around their Barclays visitors, anxiously waiting to hear new stories and lobbying for the chance to be the next reader. After reading Bunny Money and The Berenstain Bears Lend a Helping Hand with the Barclays volunteers, students took home their very own copies of each title to read independently, share with siblings and friends or have the stories read to them again.

Last week, volunteers from Barclays Wealth and Barclays Capital surprised students at Southside Elementary Museums Magnet School in Miami, Florida with a donation of 2,000 brand new books. The volunteers shared a very special afternoon of reading with the first-grade students of Southside; children crowded around their Barclays visitors, anxiously waiting to hear new stories and lobbying for the chance to be the next reader. After reading Bunny Money and The Berenstain Bears Lend a Helping Hand with the Barclays volunteers, students took home their very own copies of each title to read independently, share with siblings and friends or have the stories read to them again.

As part of a new partnership with Barclays Wealth, First Book will donate 2,000 new books to Southside Elementary for its children as well as its school and classroom libraries, where current and future students will enjoy them for years to come. In 2010, Barclays Wealth and First Book will distribute 10,000 brand new books in communities where Barclays employees work and live. We are proud to work with Barclays as the company follows it philosophy of banking on brighter futures, looking after local communities and supporting charity at work.

Blog: Teach with Picture Books (Login to Add to MyJacketFlap)

JacketFlap tags: advertising, Scholastic, media literacy, persuasive writing, financial literacy, Annick, Lerner, Admongo, Capstone, Add a tag

Our students represent a lucrative target audience. Companies bombard them daily with ads through every possible venue, so much so that most advertising is now an integral, barely noticed part of the American landscape.

And there's the rub. Barely noticed, yet there, exerting a powerful influence on how children choose to buy, think, and act.

In previous posts I've discussed persuasive writing (Convince Me: Real-Life Uses for Persuasive Writing and So What’s Your Point? Persuasive Writing Using Picture Books) as well as financial literacy (Dollars and Sense for Students). Now Scholastic has teamed up with the Federal Trade Commission to combine these two ideas, plus the concept of media literacy, to produce the Admongo site and its related teacher resources.

The FTC site explains that

Advertising is a multi-million dollar business. Truthful advertising provides benefits to consumers and competition. It gives consumers the information they need to make better-informed purchasing and product use decisions. It also gives companies an incentive to modify their products to provide features that customers want. By contrast, false advertising interferes with decision-making and hinders competition.

Tweens have their own money to spend, and parents report that children play an important role in family buying decisions. Because kids are an important part of the marketplace, they often are the targets of advertising and marketing programs. The result is that American kids see ads wherever they go.

- Who is responsible for the ad?

- What is the ad actually saying?

- What does the ad want me to do?

Blog: First Book (Login to Add to MyJacketFlap)

JacketFlap tags: Philanthropy, First Book Events, financial literacy, Barclays Capital, Barclays, Newark, North Star Academy, Bunny Money, Add a tag

When 25 volunteers from Barclays Capital arrived at North Star Academy Elementary in Newark last Tuesday to share their love of reading with elementary students, little did they know that those students, in return, would share their own fiery passion for learning and their courage to succeed.

As the “Morning Circle” routine began, kindergarten, first-grade and second-grade students chanted about their classroom pride and enthusiasm for math. Next, the Emory Eagles of second grade performed an incredible original song about matter (their current unit of study in science). When the students were finally introduced to the Barclays Capital “superheroes,” who had arrived to read brand new books with them, their young faces lit up with excitement. The scholars of North Star Academy have an unmatched love for reading, and the donation of new books, such as Bunny Money by Rosemary Wells and Tar Beach by Faith Ringgold, from Barclays Capital allows these students to take home and enjoy their very own books.

As the “Morning Circle” routine began, kindergarten, first-grade and second-grade students chanted about their classroom pride and enthusiasm for math. Next, the Emory Eagles of second grade performed an incredible original song about matter (their current unit of study in science). When the students were finally introduced to the Barclays Capital “superheroes,” who had arrived to read brand new books with them, their young faces lit up with excitement. The scholars of North Star Academy have an unmatched love for reading, and the donation of new books, such as Bunny Money by Rosemary Wells and Tar Beach by Faith Ringgold, from Barclays Capital allows these students to take home and enjoy their very own books.

In partnership with First Book, Barclays Capital has donated a total of 4,000 new books to North Star Academy this year. All of the school’s campuses are receiving these resources, which will help North Star continue to pursue its mission of closing the achievement gap. Here at First Book, we are proud to partner with Barclays Capital and North Star—two fantastic organizations that are dedicated to creating bright futures for all children.

Blog: Teach with Picture Books (Login to Add to MyJacketFlap)

JacketFlap tags: economics, financial literacy, 21st Century Skills, global learning, teaching students about money, global economy, Add a tag

When most of us hear the word economics, we think of either our present precarious financial circumstances, or of world financial issues far beyond our own understanding, let alone the understanding of our students. But the fact is, a number of variables from economics (supply, demand, surplus, and profit) are important components of simple financial literacy which our students, comprising one of the largest consumer groups in the world, need to understand in order to function and succeed in society. If they can avoid even half of the mistakes adults have made, we'll be much better off!

Understanding Global Economies

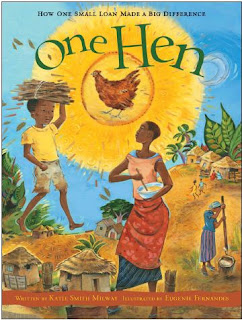

A simple picture book such as One Hen: How One Small Loan Made a Big Difference concisely illustrates how planning, hard work, and determination can equal success. At the story's start, young Kojo and his mother just barely survive by gathering and selling firewood. When Kojo is granted a small loan, he chooses to purchase a hen. The hen not only provides eggs to eat, but additional eggs to sell, With the profits, Kojo buys more hens. What's really wonderful, and only revealed at the book's end, is that Kojo is based upon real-life Kwabena Darko, a man who literally changed the economy of his entire village through a microloan. Katie Smith Milway's patient and informative narrative is perfectly matched to Eugenie Fernandes' bright, mural-like illustrations. Kids Can Press provides a free teaching resource for One Hen, and the Heifer Village game (see below) would be an excellent extension for this book.

Similarly, Cycle of Rice, Cycle of Life: A Story of Sustainable Farming (written and illustrated with photographs by Jan Reynolds) shows how people can interact with the environment, providing for their own needs while respecting natural resources. From the water temple system to the farmers' fields, the Balinese people rely upon predictable cycles for their survival. What happens when these cycles are threatened by nature's forces or human progress? Like One Hen, this book presents just a microcosm of world economy, perfect for a class study. See the three-part video series on the sustainability of rice farming at the Lee and Low Books site.

Display Comments Add a Comment

Blog: Ypulse (Login to Add to MyJacketFlap)

JacketFlap tags: George Clooney, Ypulse Essentials, financial literacy, Next Great Generation, teens for jeans, Justin Long, jersey shore, haiti, Ashley Greene, Avon Mark, Ctrl Alt Shift, Laurence Steinberg, Add a tag

Avon hits the 'Mark' (nice profile of Avon's successful campus rep program in the New York Times, reg. required. Plus Mullen launches a blog to help clients understand "The Next Great Generation")

- More 'Jersey Shore' (Blackbook concedes the show... Read the rest of this post

Avon hits the 'Mark' (nice profile of Avon's successful campus rep program in the New York Times, reg. required. Plus Mullen launches a blog to help clients understand "The Next Great Generation")

- More 'Jersey Shore' (Blackbook concedes the show... Read the rest of this post

Blog: Ypulse (Login to Add to MyJacketFlap)

JacketFlap tags: PBS, Campus, financial literacy, beth kobliner, your life, your money, Add a tag

Today's Ypulse Interview is with Beth Kobliner, a financial expert and one of the executive producers behind "Your Life, Your Money," a documentary airing tonight on PBS that takes a timely look at financial literacy among young people today. To... Read the rest of this post

Add a Comment

I've given you an award. You may pick it up on my site.

Best wishes.

http://myheartbelongs2books.blogspot.com/2010/02/another-award.html