Countries grow richer as one moves away from the equator, and the same is generally true if one looks at differences among regions within countries. However, this was not always the case: research has shown that in 1500 C.E., for example, there was no such positive link between latitude and prosperity. Can these irregularities be explained? It seems likely an answer can be found in factors strongly associated with latitude.

The post Climate and the inequality of nations appeared first on OUPblog.

By Maisy Wong

There are many policies around the world designed to encourage ethnic desegregation in housing markets. In Chicago, the Gautreaux Project (the predecessor of the Moving To Opportunity program) offered rent subsidies to African American residents of public housing who wanted to move to desegregated areas. Germany, the United Kingdom, and Netherlands, impose strict restrictions on where refugee immigrants can settle. Many countries also have “integration maintenance programs” or “neighborhood stabilization programs” to encourage desegregation. These policies are often controversial as they are alleged to favor some ethnic groups at the expense of others. Regardless of the motivation behind these policies, knowing the welfare effects is important because these desegregation policies affect the location choices of many individuals.

I am interested in one such desegregation policy in Singapore: the ethnic housing quotas. Using location choices, I analyzed how heterogeneous households sort into neighborhoods as the ethnic proportions in the neighborhood change. To do this at such a local level I had to assemble a dataset of ethnic proportions by hand-matching more than 500,000 names to ethnicities using the Singapore residential phonebook.

I am interested in one such desegregation policy in Singapore: the ethnic housing quotas. Using location choices, I analyzed how heterogeneous households sort into neighborhoods as the ethnic proportions in the neighborhood change. To do this at such a local level I had to assemble a dataset of ethnic proportions by hand-matching more than 500,000 names to ethnicities using the Singapore residential phonebook.

The ethnic housing quotas policy in Singapore is a fascinating natural experiment. It was implemented in public housing estates in 1989 to encourage residential desegregation amongst the three major ethnic groups in Singapore: Chinese (77%), Malays (14%), and Indians (8%). The quotas are upper limits on the proportions of Chinese, Malays, and Indians at a location. Locations with ethnic proportions that are at or above the quota limits are subjected to restrictions designed to prevent these locations from becoming more segregated. For example, non-Chinese sellers living in Chinese-constrained locations are not allowed to sell to Chinese buyers because this transaction increases the Chinese proportion and makes the location more segregated.

Using transactions data close to the quota limits and controlling for polynomials of ethnic proportions calculated using the phonebook, I documented price dispersion across ethnic groups that is consistent with theoretical predictions of the policy’s impact. The findings suggest a model where Chinese and non-Chinese buyers have different preferences for Chinese neighborhoods.

Indeed, my estimates show that all groups have strong preferences for living with members of their own ethnic group but the shapes of the preferences are very different across the three ethnic groups. All groups have ethnic preferences that are inverted U-shaped but with different turning points. This means that once a neighborhood has enough members of their own ethnic group, households want new neighbors from other ethnic groups. Finding tastes for diversity and differences in the shapes of ethnic preferences is consistent with previous research using data on racial attitudes from the General Social Survey in the United States and also surveys of ethnic relations in Singapore.

I used these estimates of ethnic preferences to perform welfare simulations. The seminal work by Thomas Schelling on tipping showed that externalities exist in a model with ethnic preferences because a mover affects the utility of his current and future neighbors by changing the ethnic composition of the neighborhood. Due to these externalities, Schelling showed that policies such as the ethnic quotas could potentially be used as a coordination mechanism to achieve equilibrium with integrated neighborhoods. My welfare estimates show that under the quota policy, about one-third of neighborhoods are close to the optimal allocation of Chinese, Malays, and Indians respectively.

Maisy Wong is Assistant Professor in Real Estate at Wharton, University of Pennsylvania. Her paper, ‘Estimating Ethnic Preferences Using Ethnic Housing Quotas in Singapore’ can be read in full and for free in The Review of Economic Studies.

The Review of Economic Studies aims to encourage research in theoretical and applied economics, especially by young economists. It is widely recognised as one of the core top-five economics journal, with a reputation for publishing path-breaking papers, and is essential reading for economists.

Subscribe to the OUPblog via email or RSS.

Subscribe to only business and economics articles on the OUPblog via email or RSS.

Image credit: HDB flats at Tampines New Town. By Terence Ong. [Creative Commons], via Wikimedia Commons.

The post Do people tend to live within their own ethnic groups? appeared first on OUPblog.

By Irina A. Telyukova

In the United States, around 25% of households tend have a substantial amount of expensive credit card debt that they carry over multiple months or even years, while also holding significant liquid assets, i.e. balances in checking and savings accounts.

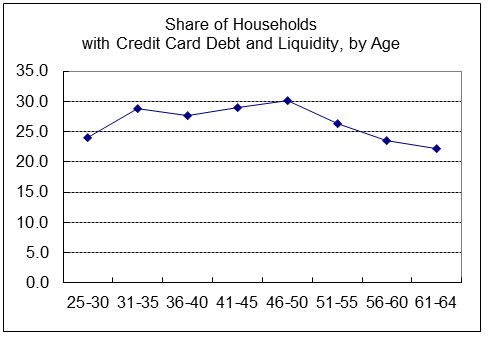

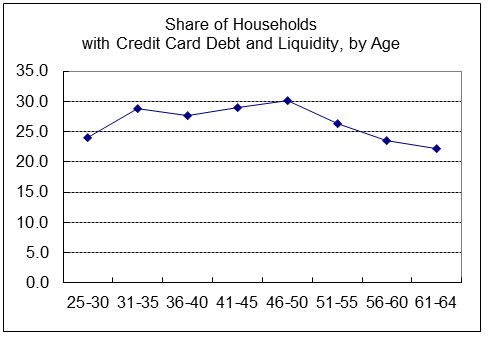

For example, in 2001 data, such households paid an average 14% interest rate on the credit card, while earning nearly no return on the bank accounts. A median such household had $3800 in credit card debt, and $3000 in the bank. The average amounts were about $5800 and $7200, respectively. This behavior is quite persistent with age, as the picture below shows. It is also persistent over time, at least over the last two decades. The statistics for 2010 are very close to those for 2001.

It may seem that given the cost of revolving credit card debt, people should pay it off if they have any money in the bank. Hence, the phenomenon has been termed the “credit card debt puzzle”. Much of the discussion of it in the literature interpreted it as evidence that people lack self-control, or that they lack the financial sophistication to plan properly. In my study, I instead focused on a more familiar idea: that people hold on to money in the bank because they may need it for expenses for which credit cannot be used, and such expenses could be large and unexpected. Not only do we pay our rents and mortgages still largely by check or electronic payment from the bank, but if we have a large car or home repair to take care of, the contractor might give preferential pricing to a cash payment or simply not accept credit cards. Indeed I find that homeowners are more likely to simultaneously have debt and money in the bank, and that home repairs are an important source of large and unpredictable expenses for most households. Then, even if a household has credit card debt, it may not be optimal to draw down the bank account to zero to repay the debt. Incidentally, this idea has been advanced in the past by those who have studied the same behavior on the side of firms.

The story is intuitive; the difficult part is measuring how well this explanation can account for the puzzle, because we do not have good data on how people pay for things during a typical month, and because it is difficult to disentangle which expenses are unpredictable. Nevertheless, using several household surveys and a model of household portfolio choice, I measured both typical monthly liquid expenses (i.e. those done by cash, check, debit and other ways that require the bank account to have a positive balance), and the extent of uncertainty in them. I find that for the median person, there appears to be enough uncertainty to warrant holding on the order of $3,000 of liquid assets, even if she has credit card debt as well. In other words, many people who simultaneously have credit card debt and money in the bank are behaving without violation of self-control or rationality, under the constraint that they do not have enough money both to pay off their debt and attend to their expected monthly expense needs.

The story is intuitive; the difficult part is measuring how well this explanation can account for the puzzle, because we do not have good data on how people pay for things during a typical month, and because it is difficult to disentangle which expenses are unpredictable. Nevertheless, using several household surveys and a model of household portfolio choice, I measured both typical monthly liquid expenses (i.e. those done by cash, check, debit and other ways that require the bank account to have a positive balance), and the extent of uncertainty in them. I find that for the median person, there appears to be enough uncertainty to warrant holding on the order of $3,000 of liquid assets, even if she has credit card debt as well. In other words, many people who simultaneously have credit card debt and money in the bank are behaving without violation of self-control or rationality, under the constraint that they do not have enough money both to pay off their debt and attend to their expected monthly expense needs.

While the story accounts for the median amount of money held in the bank by those who also have credit card debt, the average household has a lot more money in the bank, and more money than credit card debt. This means that there are people who have very large amounts of liquid assets while still revolving credit card debt. While such households may face more severe risks than the average case that I measured, and while some may hold money in the bank because they foresee a possibility of a job loss and want to be able to pay at least their average expenses, it does suggest that some people may be able to improve their financial positions by examining their bank and credit card balances, and the interest costs that they pay on the credit card debt, to see if they can pay off some of their debt using their money in the bank.

Irina A. Telyukova is an assistant professor of economics at the University of California, San Diego. Her research focuses on different aspects of household saving. She has several publications on credit card debt and money demand. Her current research is about the use of home equity in retirement, in the United States and across countries, including a study about reverse mortgages. She is the author of the paper ‘Household Need for Liquidity and the Credit Card Debt Puzzle’, which appears in The Review of Economic Studies.

The Review of Economic Studies aims to encourage research in theoretical and applied economics, especially by young economists. It is widely recognised as one of the core top-five economics journal, with a reputation for publishing path-breaking papers, and is essential reading for economists.

Subscribe to the OUPblog via email or RSS.

Subscribe to only business and economics articles on the OUPblog via email or RSS.

Image Credits: (1) Graph produced by the author. Do not reproduce without permission. (2) Credit Card. By Gökhan ARICI, iStockphoto

The post Why don’t people pay off credit card debt? appeared first on OUPblog.

By John Knowles

If you become wealthier tomorrow, say through winning the lottery, would you spend more or less working than you do now? Standard economic models predict you would work less. In fact a substantial segment of American society has indeed become wealthier over the last 40 years — married men. The reason is that wives’ earnings now make a much larger contribution to household income than in the past. However married men do not work less now on average than they did in the 1970s. This is intriguing because it suggests there is something important missing in economic explanations of the rise in labor supply of married women over the same period.

One possibility is that what we are seeing here are the aggregate effects of bargaining between spouses. This is plausible because there was a substantial narrowing of the male-female wage gap over the period. The ratio of women’s to men’s average wages; starting from about 0.57 in the 1964-1974 period, rose rapidly to 0.78 in the early 1990s. Even if we smooth out the fluctuations, the graph shows an average ratio of 0.75 in the 1990s, compared to 0.57 in the early 1970s.

The closing of the male-female wage gap suggests a relative improvement in the economic status of non-married women compared to non-married men. According to bargaining models of the household, we should expect to see a better deal for wives—control over a larger share of household resources – because they don’t need marriage as much as they used to. We should see that the share of household wealth spent on the wife increases relative to that spent on the husband.

Bargaining models of household behavior are rare in macroeconomics. Instead, the standard assumption is that households behave as if they were maximizing a fixed utility function. Known as the “unitary” model of the household, a basic implication is that when a good A becomes more expensive relative to another good B, the ratio of A to B that the household consumes should decline. When women’s wages rose relative to men’s, that increased the cost of wives’ leisure relative to that of husbands. The ratio of husbands’ leisure time to that of wives should therefore have increased.

In the bargaining model there is an additional potential effect on leisure: as the share of wealth the household spends on the wife increases, it should spend more on the wife’s leisure. Therefore the ratio of husband’s to wife’s leisure could increase or decrease, depending on the responsiveness of the bargaining solution to changes in the relative status of the spouses as singles.

To measure the change in relative leisure requires data on unpaid work, such as time spent on grocery shopping and chores around the house. The American Time-Use Survey is an important source for 2003 and later, and there also exist precursor surveys that can be used for some earlier years. The main limitation of these surveys is that they sample individuals, not couples, so one cannot measure the leisure ratio of individual households. Instead measurement consists of the average leisure of wives compared to that of husbands. The paper also shows the results of controlling for age and education. Overall, the message is clear; the relative leisure of married couples was essentially the same in 2003 as in 1975, about 1.05.

One can explain the stability of the leisure ratio through bargaining; the wife gets a higher share of the marriage’s resources when her wage increases, and this offsets the rise in the price of her leisure. This raises a set of essentially quantitative questions: Suppose that marital bargaining really did determine labor supply how big are the mistakes one would make in predicting labor supply by using a model without bargaining? To provide answers, I design a mathematical model of marriage and bargaining to resemble as closely as possible the ‘representative agent’ of canonical macro models. I use the model to measure the impact on labor supply of the closing of the gender wage gap, as well as other shocks, such as improvements to home -production technology.

People in the model use their share of household’s resources to buy themselves leisure and private consumption. They also allocate time to unpaid labor at home to produce a public consumption good that both spouses can enjoy together. We can therefore calibrate the model to exactly match the average time-allocation patterns observed in American time-use data. The calibrated model can then be used to compare the effects of the economic shocks in the bargaining and unitary models.

The results show that the rising of women’s wages can generate simultaneously the observed increase in married women’s paid work and the relative stability of that of the husbands. Bargaining is critical however; the unitary model, if calibrated to match the 1970s generates far too much of an increase in the wife’s paid labor, and far too large a decline in that of the men; in both cases, the prediction error is on the order of 2-3 weekly hours, about 10% of per-capita labor supply. In terms of aggregate labor, the error is much smaller because these sex-specific errors largely offset each other.

The bottom line therefore is that if, as is often the case, the research question does not require us to distinguish between the labor of different household or spouse types, then it may be reasonable to ignore bargaining between spouses. However if we need to understand the allocation of time across men and women, then models with bargaining have a lot to contribute.

John Knowles is a professor of economics at the University of Southampton. He was born in the UK and schooled in Canada, Spain and the Bahamas. After completing his PhD at the University of Rochester (NY, USA) in 1998, he taught at the University of Pennsylvania, and returned to the UK in 2008. His current research focuses on using mathematical models to analyze trends in marriage and unmarried birth rates in the US and Europe. He is the author of the paper ‘Why are Married Men Working So Much? An Aggregate Analysis of Intra-Household Bargaining and Labour Supply’, published in The Review of Economics Studies.

The Review of Economic Studies aims to encourage research in theoretical and applied economics, especially by young economists. It is widely recognised as one of the core top-five economics journals, with a reputation for publishing path-breaking papers, and is essential reading for economists.

Subscribe to the OUPblog via email or RSS.

Subscribe to only business and economics articles on the OUPblog via email or RSS.

Image credit: Illustration by Mike Irtl. Do not reproduce without permission.

The post Why are married men working so much? appeared first on OUPblog.